Welcome to the manufacturing ecosystem of Piemonte & Aosta Valley

In our second ecosystem article, we embark on a journey through the manufacturing scene of Piemonte & Aosta Valley region and disclose the initiatives led by the greenSME clusters. This article is powered by the MESAP cluster.

- What regions are covered by your cluster? Piemonte & Aosta Valley

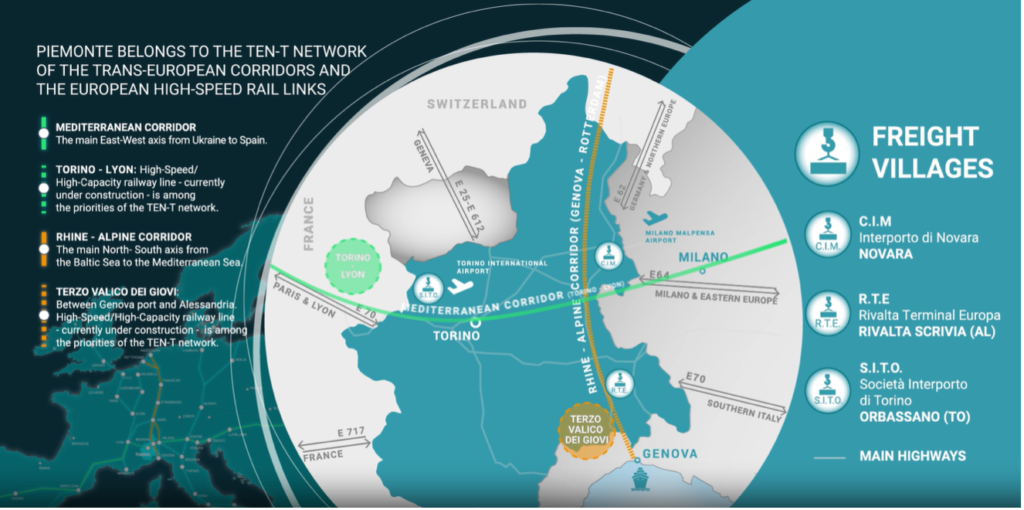

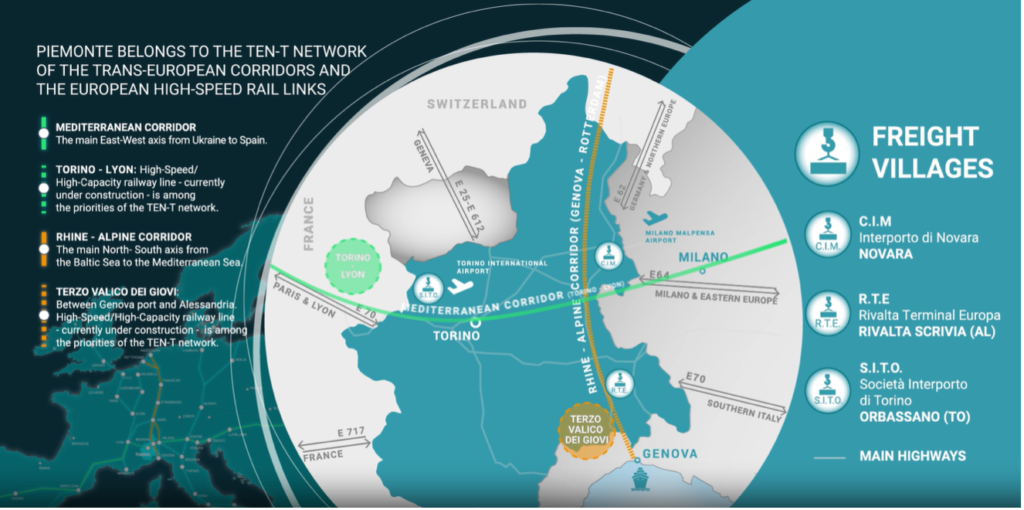

Courtesy of Piemonte Agency for Investments, Export and Tourism

2. What is the representation of manufacturing in terms of all companies in the region?

With a GDP of approximately € 140 billion (8% of the national total), 430,000 companies (7% of the national total), and an export of about € 50 billion (10% of the national total), Piemonte ranks among the top 5 regional economies in Italy. [1] The region has an industrial DNA:

- it is the national reference point for the automotive and transportation sector (mobility), accounting for about 45% of the national automotive sector’s total revenue and proving to be the leader in terms of automotive and transportation component companies.

- Piemonte’s aerospace sector records a turnover of € 7 bn and 20,000 employees, thanks to big players such Leonardo, Thales Alenia Space, GE Avio, ALTEC, Collins Aerospace and Mecaer to mention a few and smart SMEs such as APR, EICAS Automazione, LMA.

- Manufacturing remains a strong asset for the region, thanks to a great ecosystem of SMEs and big players operating in manufacturing equipment, machines and automation, semiconductors, briefly industry 5.0: to mention a few, Prima Industrie, Comau, Kuka, Fidia, Vishay, SPEA, Engineering, Inpeco, SKF and dynamic SMEs such as Eurofork, Novasis Innovazione, IDT Solution, Beond, IRIS…

- Characterise the manufacturing companies in the region according to size:

- large enterprises (employing 250 or more persons)

- medium-sized enterprises (employing 50 to 249 persons)

- Small enterprises (employing 11 to 49 persons)

- Micro enterprises (employing less than 10 persons).

| Area | Piemonte Region | ||||||||||

| Year | 2021 | ||||||||||

| Type of information | Number of companies | Number of employees of active enterprises (annual average values) | |||||||||

| Employees per company | 0-9 | 10-49 | 50-249 | >250 | total | 0-9 | 10-49 | 50-249 | >250 | total | |

| Ateco 2007 (last upgrade 2022) | |||||||||||

| 0010: TOTAL | 315.950 | 13.462 | 1.820 | 343 | 331.575 | 555.228 | 240.931 | 180.730 | 391.578 | 1.368.467 | |

| % | 95,3% | 4,1% | 0,5% | 0,1% | 100,0% | 40,6% | 17,6% | 13,2% | 28,6% | 100,0% | |

| C: manufacturing activities | 22.822 | 4.595 | 844 | 15 7 | 28.418 | 60.573 | 88.246 | 82.923 | 155.100 | 386.843 | |

Data in the C section reveal the predominant presence of micro and small enterprises, able to be flexible, make decisions fast and customise the production; on the other side, this dimension also means difficulties to face perturbation (shortage, energy costs, single client relationship, capacity to innovate, optimise the production, change the mindset)

3. In general, what funding stages (Seed, Series A, Series B, and Series C) are the companies at? Please provide percentages, if known.

We don’t have this information because our associates are 80% consolidated SMEs.

For your interest, the region includes three main incubators/accelerators that support startups.

ESA BIC Turin supports space-related start-ups in Piemonte: it refers to applications that use space-based systems, such as satellite navigation, earth observation, or satellite communication. https://www.esabic-turin.it/program

I3P Incubator of Politecnico di Torino supports the ecosystem of entrepreneurship, by collaborating with private subjects and institutions, engaged in research and advanced training, in services for technology transfer, in the financing of innovation, in internationalisation. I3P is the best public business incubator in the world, as recognized by the World Rankings of Business Incubators and Accelerators 2019-2020 published by UBI Global. https://www.i3p.it/en/

2i3T ‘s mission is to diffuse and foster knowledge transfer within the University environment to develop local economy creating new businesses coming out from academic research and SMEs. The Incubator started activities in April 2007 and since that time it launched 96 startups knowledge based in the following sectors: 34% Health Science, 20% in Agrofood, Digital for 16%, 14% Social Innovation and 14% Cleantech. https://www.2i3t.it/en/homepageenglish/

4. How has the manufacturing sector evolved in the three pillars of sustainability (environmental, social and economic) in your region over the past decade, and what are the key factors driving this change?

Piemonte is considered the birthplace of the Italian industry, beginning with textiles in the 19th century, moving to the automotive and aerospace industries in the 20th century, and, more recently, shifting towards IT and services. Diversifying the regional economy beyond its traditional strengths in core industrial activities such as automotive is part of its strategy to avoid critical situations such as the deepest crisis of FIAT.[2]

The area has been selected to receive tailored support under the Commission pilot action for industrial transition (Regions in industrial transition),[3] starting by redesign a strategy for regional economic transformation based on its S3 smart specialisation strategy and priorities (2014-2020) that have been recently revised according to the green transition, the digital transformation and the well-being of local communities (2021-2027). The regional Metacluster Sistema Poli Innovazione Piemonte[4] made of 7 clusters specialised in thematic areas works by considering this approach.

Piemonte is also part of the Vanguard initiative[5] where almost 40 EU regions work together to stimulate industrial innovation based on complementarities in regional smart specialisation strategies to develop solutions for significant societal challenges while delivering on the EU’s ambitions for improved international competitiveness.

Moreover, Piemonte has finalised its Regional Strategy for Sustainable Development (SRSvS)[6] to outline the areas and objectives that the Piedmont Region intends to pursue within the UN Agenda 2030, the EU Green Deal and the implementation of the National Strategy for Sustainable Development.

5. What challenges or obstacles in sustainability do manufacturers in your region face, and how have they adapted to overcome them?

Adapting to transition: SMEs face challenges to understand and adequate themselves to sustainability. The 3 major challenges are

- Limited Resources such as tighter budgets and smaller teams make difficult for them to invest in sustainable technologies, hire specialised personnel, or allocate sufficient time and funds for sustainability initiatives.

- Lack of Expertise: Sustainability is a complex field with a wide range of regulations and technologies and SMEs often lack in house experts to guide them on their sustainability journey.

- Insufficient Awareness: many SMEs may not fully understand the significance of sustainability in the current market, or they may struggle to communicate their sustainability efforts.

Adapting to stay competitive: Large companies and tier one are requiring supply chain companies to complete questionnaires or produce additional ESG data according to the CSDD Corporate sustainability due diligence[7].

Adapting to access finance: the European Central Bank is pushing in sustainable finance. Banks and credit institutions need to report obligations (taxonomy alignments) and related economic impacts increase (sustainable rating) and this ESG information data will in turn be requested and passed on to companies.

New markets opportunities: The green and digital transition offers insights into new markets, new products and requires rethinking linear business models from a circular perspective. Opportunity to review the company’s position vis-à-vis stakeholders and seize the opportunities of a changing world.

Skilled people attraction: Sustainability path can attract the younger skilled generation that is very sensitive on this topic; training, upskilling and reskilling of internal staff from an ESG perspective can be an opportunity for the future.

Better performance: companies achieving the best EGS performance are also the most solid, with the lowest credit risk: the phenomenon transcends company size but becomes more relevant for small and medium-sized companies, which are up to 5 times less risky if they adopt high-performance sustainability policies. [8]

Change in family business: parents who have built a business wishes to pass it on to their children, teach them the trade and place them in the company.

- Information Culture and Structure: for many businesses, having a laid-back culture is a positive. However, the informal structure and culture found in many family businesses can equate to a lack of documentation, policies, and defined strategies and goals.

- Pressure to Hire Family Members: It can be difficult to resist the pressure that comes along with requests from family members who want to join the business.

- Lack of Training: The informal culture found in many family businesses can result in a lax approach to training new employees, whether they are family members or not.

- High Turnover of Non-Family Employees: Non-family employees may feel that greater opportunities exist within the business for those who are a part of the family and may grow tired of the culture.

- Lack of an External View: While family members may not always have the same opinions, they often have similar upbringing and life experiences which may lead to a uniform view of the business. Businesses need to have external views of their company and their competition in order to thrive.

7. How does your cluster support the companies in becoming more sustainable? What services do you provide to companies?

Mesap cluster supports companies in becoming more sustainable by participating in EU-funded projects with cascade funds for SMEs not only addressing but focused on sustainability topics. In fact, alongside greenSME we are also involved in:

- Silicon Eurocluster[9] project aims to achieve greater European self-sufficiency, with increased competitiveness and resilience in the electronics value chain, with specific attention to SMEs. It launches the opening of the Call for Expressions of Interest, seeking highly skilled and experienced green consultancy service providers to support the sustainable transformation of Small and Medium-sized Enterprises (SMEs) operating in the electronics sector who can ask for consultancy green vouchers of €3600 each for contracting external consultancy services, facilitating their green transformation. The call for asking vouchers will open in February 2024.

- MC0 (Mission Carbon 0)[10] offers companies in the ALCOTRA region (Italy-France) a simplified ‘carbon diagnosis’ to support them individually and collectively in their decarbonisation path by awareness ateliers, training sessions on decarbonisation for SMEs and SMES and the creation of a footprint diagnosis platform.

As underlined above, we collaborate with the regional metacluster Sistema Poli Innovazione Piemonte that includes a specific strategy – strand “green transition” – to support companies in their sustainability path. One of its members is Polo Clever (Environment Park), the Piedmontese cluster on green and clean technologies, with whom we work to evangelise companies on green topics and sustainable topics such as smart mobility (electric, hydrogen) and smart manufacturing (KET applications for the sustainability of the industrial processes, sustainable design of product and processes, reuse of secondary materials from production cycles…).

In Aosta Valley we are part of the EVA+ consortium[11] Energy for Aosta Valley for the digital and sustainable use of resources[12]): it is the Region’s initiative to support, promote and valorise local companies in developing green solutions. We collaborate with the ESG office of Unione Industriali Torino, providing assessment to help companies of their own level of sustainability.

By working within these projects and collaborating with these strategic stakeholders we organise workshops, webinars and events to increase awareness, provide strategic information and training about the ESG topics, showcase success companies’ stories, present tools to self-assess and upgrade companies’ sustainability.

Authors: Fabrizio Fallarini, Alessia Menduni, Mangiantini Marco

[1] https://www.centroestero.org/en/invest-in-piemonte/why-invest-in-piemonte.html

[2] The crisis started in the early 1990s, when the global auto industry significantly worsened, with all major carmakers enduring terrible results. This affected Fiat in particular, which had a 43% share of the internal market and 12% of the European market. As a consequence of very negative results in the first half of 1993, the Fiat Group prepared itself to lay off around 12,000 employees in Italy https://usienaicm.wp.unisi.it/wp-content/uploads/sites/63/2014/12/Di-Minin-A.-F.-Frattini-and-A.-Piccaluga.-2010.-Fiat-Open-Innovation-in-a-Downturn-1993-2003.-California-Management-Review-523-132-59..pdf

[3] https://ec.europa.eu/regional_policy/en/information/publications/factsheets/2018/pilot-action-regions-in-industrial-transition

[4] https://sistemapolipiemonte.it/clusters/?lang=en

[5] https://www.s3vanguardinitiative.eu/members

[6] https://www.regione.piemonte.it/web/temi/strategia-sviluppo-sostenibile/strategia-regionale-per-sviluppo-sostenibile-0

[7] https://commission.europa.eu/business-economy-euro/doing-business-eu/corporate-sustainability-due-diligence_en

[8] Source https://www.repubblica.it/economia/rapporti/obiettivo-capitale/mercati/2022/10/06/news/le_pmi_sostenibili_hanno_un_rischio_di_default_5_volte_inferiore-368808633/

[9] https://www.silicon-europe.eu/nc/news/news/news-detail/archive/2023/november/article/silicon-eurocluster-launches-call-for-green-consultancy-services-to-propel-smes-sustainable-transfo/29/

[10] https://www.interreg-alcotra.eu/it/mc0-missione-carbonio-0-accelerare-la-decarbonizzazione-degli-iptsmi

[11] https://www.mesap.it/collaborazioni/eva-valle-daosta/

[12] https://www.mesap.it/collaborazioni/eva-valle-daosta/